THE100

MOST

OVERPAID

CEOs

Are Fund Managers

Asleep at the Wheel?

KEY TAKEAWAYS

Since As You Sow published the first "The Most Overpaid CEOs report" in 2015, in each and every report, the companies with the most overpaid CEOs suffer lower returns for shareholders than the average S&P 500 company. Cumulating these underperformances over all seven years of this report series, a rolling portfolio of the most 100 overpaying companies each year would have returned a full 20 percentage points less than the S&P 500 average.

2021 showed substantial increases in opposition to CEO pay packages. A record 16 companies had CEO pay packages rejected by more than half of the shareholders, a 60 percent increase from the ten in 2020 and more than double the seven in 2019. Using a calculation that excludes management and “insiders” and includes just institutional shareholders, the number of CEO pay packages that were rejected by more than a majority of institutionally held shares was 29, almost twice the 15 we saw last year. Semler Brossy, a leading independent executive compensation consulting firm, provides statistics that indicate that the average vote against the CEO pay package at S&P 500 companies increased by 1.3 percentage points, from 10.4 percent in 2020 to 11.7 percent in 2021, i.e. a 12.5 percent increase in the number of votes against the CEO pay package, “on average”, at S&P 500 companies¹.

This increase in opposition seems to be based on more companies employing questionable practices and metrics in setting CEO pay. It does not seem to be based on the total amount of pay. For example, companies that changed CEO pay performance metrics this year using COVID-19 as the excuse received high levels of negative votes from shareholders.

Because CEO pay is highly peer group linked, an increase that may appear justified at one company then inflates pay at many other companies in the company’s peer group. This ratchets up the pay of all CEOs, and shareholders do not seem to object.

Click on each column name to sort.

This report has a strong focus on financial manager voting, which is disclosed on an annual basis. The pay packages evaluated were those voted on in the year prior to June 30, 2021. Thus, some CEOs presented here and in Appendix A no longer hold those positions.

Introduction

This is the eighth year As You Sow has issued this report and a year where COVID-19 influenced voting outcomes. Shareholder opposition to CEO pay packages increased in the year ended June 30, 2021. CEO pay also continued to increase compared to the previous year.

Despite last year’s stories of CEOs promising to cut their own base salaries during the pandemic, later analysis showed this move had only a minimal effect on their total pay. ISS noted, “The median CEO pay package was at an all-time high in both [S&P 500 and Russell 3000] indices, despite the fact that many companies froze or reduced base salaries in response to the pandemic.” ISS says that total pay went up primarily “due to larger long-term equity incentives” given to the CEOs.²

CEOs’ gains are much higher when realized pay is counted as the Economic Policy Institute (EPI) has done. EPI calculated that CEOs at the top 350 firms in the U.S. were paid an average of $24.2 million when measuring the value of stock options when they are exercised instead of the date they are granted, and the value of stock awards is measured on the date the stock vests instead of the date on which the stock options were granted. This $24.2 million figure is much more than the $14.5 million figure reported in the companies’ annual proxy statements.

Because front-line worker pay remained essentially flat for many years, the ratio between employee and CEO pay grew particularly stark. The EPI report found that, “in 2020, the ratio of CEO-to-typical-worker compensation was 351-to-1 under the realized measure of CEO pay; that is up from 307-to-1 in 2019 and a big increase from 21-to-1 in 1965 and 61-to-1 in 1989.”³

SHAREHOLDER RESPONSE TO EXCESSIVE CEO PAY

When more than 50 percent of shareholders vote against a particular CEO pay package, it is said that the “say on pay” vote “failed.” A record 16 S&P 500 companies had CEO pay packages rejected by more than half of the shareholders, a 60 percent increase from the ten in 2020 and more than double the seven in 2019.

Increased shareholder opposition to CEO pay packages is not just evident in votes that “fail,” but also in the number of votes moving closer to that threshold. Thirty-two of S&P 500 companies had more than 40 percent of shares oppose the CEO pay package, a fourfold increase since 2017 when only eight companies saw the same level of opposition. This follows a trend of increasing opposition to executive compensation in the last few years, with 20 companies in 2020 and 14 companies in 2019 seeing the same 40 percent or more level of opposition.

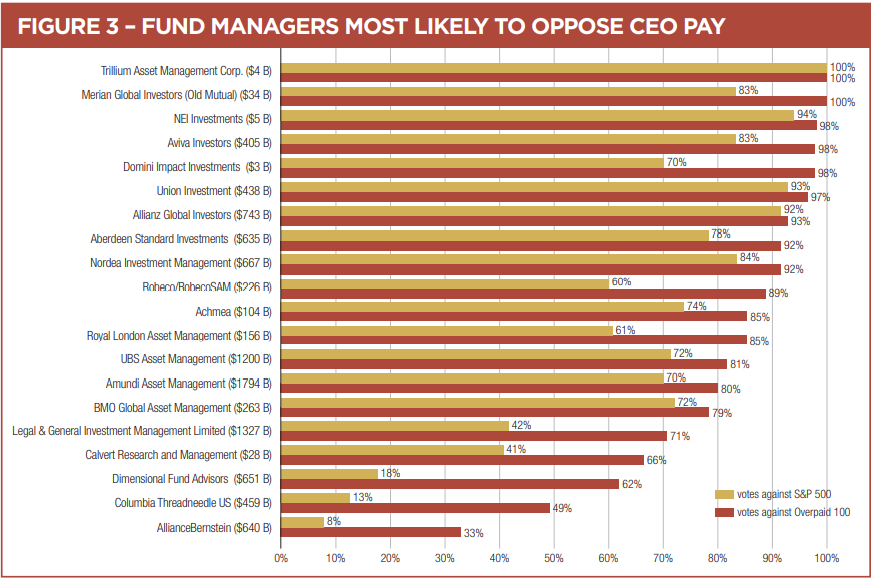

Opposition may be increasing because some shareholders have grown frustrated with engagement’s limited results. A headline in The Financial Times regarding the UK’s largest asset manager, Legal and General Investment Management (LGIM), read: LGIM ends feedback on executive pay after finding it mostly ignored. “Most companies don’t act on the remuneration feedback we give them,” Angeli Benham, senior global ESG manager at LGIM told The Financial Times. “Companies tend to do what’s right for management rather than listening to us, a shareholder.”⁴ LGIM voted against 70 percent of 100 Most Overpaid CEOs and against 41.6 percent of the S&P 500 CEOs.

SHAREHOLDER RESPONSE TO COVID-19 AND CEO PAY PACKAGES

Last year, we reported on policy changes that were created when the expectation was that COVID-19 would impact important performance metrics that determined CEO pay. Many compensation committees took steps to insulate CEOs from the financial impacts of the pandemic. This year, we saw the shareholder response to these actions.

Norwegian Cruise Line was severely impacted by the pandemic, reporting a $4 billion loss and an 80 percent decrease in revenue. Yet, the board awarded the CEO, Frank Del Rio, pay of $36 million (making him the number two Most Overpaid CEO on our list), raising his 2020 compensation to twice that of 2019. Nine of Norwegian Cruise Lines’ largest investors voted against this change, with only one, Northern Trust Investments, approving the proposal. Overall, 96 percent of shares held by Institutional Investors voted against Mr. Del Rio’s increased pay.

Sealed Air Corporation extended timing on performance shares that would otherwise have been forfeited. Both ISS and Glass Lewis then recommended that shareholders vote against the revised CEO pay package. Vanguard agreed and voted against, but BlackRock voted in favor.

At TransDigm Group, the compensation committee allowed the performance options of multiple executives to vest despite not attaining annual goals. Both ISS and Glass Lewis recommended that shareholders vote against this, and both BlackRock and Vanguard agreed and voted against.

We note that a few CEOs temporarily reduced a very small part of their pay package, namely their base salaries, often with public announcements, but the action was quietly reversed with much less fanfare. Overall, as we have seen above, CEO total pay for the S&P 500 went up despite this.

Case Study

WALGREENS BOOTS ALLIANCE

The first notable compensation vote failure of 2021 was the first time investors really weighed in on companies that insulated executive pay from the impact of COVID-19; 52.5 percent of Walgreens Boots Alliance shareholders voted against the pay package at the company’s January 31 meeting. When only 13F filers are used in the calculation, the result is starker with 72 percent opposition.

When pre-set targets and metrics were not met due to COVID-19, the company simply changed both its short-term and long-term incentive programs, resulting in total compensation of $17,483,187. As BMO Global Asset Management stated regarding the shifting metrics, “This has shielded management from negative consequences experienced by investors and other stakeholders.”

One of the largest shareholders, Vanguard, voted against, noting, “The Investment Stewardship team identified elements in the Walgreens compensation program that were not in the best long-term interests of Vanguard shareholders, particularly the use of upward adjustments during the pandemic—changes that did not appropriately reflect Walgreens’ performance versus peers. The company’s compensation committee employed discretion through the use of a scorecard for the final six months of the three-year compensation performance period— a time frame that coincided with the COVID-19 pandemic. We had questions about the rigor of the scorecard in part because of limited disclosure.”

All the major proxy advisors (ISS, Glass Lewis, PIRC) recommended against this proposal.

In addition to Vanguard, other financial managers that opposed pay included SSgA, Fidelity Management & Research, Dimensional Fund Advisors, and Geode Capital Management.

Financial managers that voted to approve the CEO pay package include BlackRock, Capital Group, and Northern Trust Investments.

HOW WE IDENTIFY THE 100 MOST OVERPAID CEOS

To identify the 100 Most Overpaid CEOs, we evaluate the CEO pay at S&P 500 companies using data provided by Institutional Shareholder Services (ISS). Further data and analysis provided by HIP Investor computes what the pay of the CEO would be, assuming such pay is related to cumulative Total Shareholder Return (TSR) over the previous five years, using a statistical regression model. This provides a formula to calculate the amount of excess pay each CEO receives. We then add data that ranks companies by what percent of company shares voted against the CEO pay package.

A newer calculation of shareholder votes by Insightia uses only the votes of institutional investors (those required to file SEC Form 13F) in both the numerator (shares voted against) and denominator (total shares voted) to calculate percentage opposition. This calculation gives a more accurate indication of institutional investors’ level of dissatisfaction, most obviously in cases where insiders own a particularly large portion of stock or there are dual class shares. More information on this and a comparison between reported votes and what we are calling “institutional votes” can be found in Appendix B. Finally, we rank companies by the ratio of the CEO’s pay to the pay of the median company employee.

The rankings of companies by excess CEO pay and by shareholder votes on CEO pay are each weighted at 40 percent. The final ranking based on CEO-to-worker pay ratio is weighted at 20 percent. The complete list of the 100 Most Overpaid CEOs using this methodology is found in Appendix A. The regression analysis of predicted and excess pay calculated by HIP Investor is found in Appendix C, and its methodology is explained further there.

Case Study

GENERAL ELECTRIC

General Electric, the number three company on our Overpaid CEOs list, failed its "say on pay” vote with an against vote of 57.4 percent (62 percent according to 13F vote). In August of 2020, the compensation committee modified CEO Larry Culp’s 2018 employment agreement and lowered the target for share prices that triggered vesting on previously granted performance shares. According to Boston Business Journal, the Glass Lewis report (which gave GE an “F” on pay-for-performance) noted that “the revised award provides Mr. Culp with the same amount of compensation in dollars for creating less shareholder value, even as the revised grant allows for greater upside opportunity (and dilution) on account of the higher number of shares covered.” In addition to identifying similar concerns with the grant, ISS highlighted the discretionary nature of executive bonuses at GE.5

GE was one of about a dozen companies this year where shareholders actively launched campaigns urging other shareholders to vote against pay. In a letter filed at the SEC, CtW Investment Group (now known as SOC Investment Group) wrote, “Never in recent history has a CEO been compensated so handsomely for a decline in the stock price.”6

GE is the highest company on our overpaid list with a lack of voting consensus among its largest investors: BlackRock and SSgA voted against, while Vanguard and T. Rowe Price, the largest shareholder of GE, voted in favor

PROXY ADVISORS

The two largest proxy advisors are Institutional Shareholder Services (ISS) and Glass Lewis. Other smaller firms that act as advisors and proxy voting agents include Egan-Jones and Segal Marco. In the non-U.S. market, firms include SHARE, PIRC, and Federated Hermes.

In 2021, ISS recommended voting against 11 percent of the CEO pay packages at S&P 500 companies and against 45 percent of the 100 Most Overpaid CEOs. These percentages are based on the ISS “standard” policy. ISS also offers voting recommendations based on other policies (e.g., a Socially Responsible Investor (SRI) policy, a public pension fund policy, and a Taft-Hartley policy). Differences between the standard and SRI policy are minimal on compensation issues. ISS SRI recommended against pay at just five additional companies in the 100 Most Overpaid Companies: 3M, Centene, Dollar General, Sysco, and Tractor Supply. Thus, the SRI policy recommended votes against 50 percent of the 100 Most Overpaid CEOs.

The ISS Taft-Hartley policy was designed to appeal to Labor Union pension funds. This season, the Taft-Hartley policy recommended voting against 65 percent of the 100 Most Overpaid CEO pay packages. The most significant difference between the Taft-Hartley policy and the standard policy seems to be a sentence in that policy that says votes against can be triggered when “the board has failed to demonstrate good stewardship of investors’ interests regarding executive compensation practices.” The public pension fund policy closely tracks the Taft-Hartley policy on compensation.

Glass Lewis uses a model comparing CEO pay in relation to company peers and company performance compared to peers. It awards letter grades between “A” and “F.” An “A” means that the percentile rank for compensation is significantly less than its percentile rank for company performance. In 2021, Glass Lewis recommended shareholders vote against 12.4 percent of CEO pay packages at S&P 500 companies and against 50 percent on the 100 Most Overpaid CEOs list. This is a 14 percent increase in vote against recommendations for the 100 Most Overpaid CEOs. These percentages are based on the Glass Lewis “standard” policy. Glass Lewis also offers ESG and Taft-Hartley policies. The ESG policy voted against 57 percent of the 100 Most Overpaid CEOs list and the Taft-Hartley policy voted against 52 percent.

Segal Marco serves over 600 clients with total advisory assets exceeding $500 billion and voted against 61 percent of the 100 Most Overpaid CEOs.

The Shareholder Association for Research and & Education (SHARE) has traditionally been the largest proxy advisor service in Canada. SHARE's proxy voting service has been migrated to GIR, which is a new organization partly owned by SHARE and partly owned by the original Groupe Investissement Responsable in Montréal. It advised against all 65 of the 100 Most Overpaid companies held in their portfolio.

PIRC, one of the largest proxy advisors in Europe, recommended against 75 percent of the 100 Most Overpaid CEOs and abstained on the others.

CASE STUDIES

PHILIP MORRIS

Company case studies in this report have typically focused on pay packages with high opposition and identified the funds that offer continued support for these egregious pay packages. Our Top 100 Overpaid CEOs list also serves to identify companies, like Philip Morris, that fly under the radar with lower opposition to their pay packages but consistently have excessive pay. In 2020, over 90 percent of shareholders supported the $21,936,798 pay package of Philip Morris CEO André Calantzopoulos. In addition, Calantzopoulos has three separate pension funds with a combined present value of over $38 million and owns over 800,000 shares of stock worth close to $80 million.

Most shareholders voted in favor of that package, providing a rationale like Invesco’s statement, “No significant concerns have been identified.” However, the State of Rhode Island Pension Fund voted against the pay package because “the magnitude of CEO pay exceeds the 75th percentile of the company's peer group, while company performance is below its industry peer median.”

As often is the case, European funds have shown more fortitude in voting against such packages. Aviva voted against the package because, among other reasons, “pay ratio is excessive (CEO vs employee).”

Pensionskasse SBB, one of the largest pension funds in Switzerland with $17 billion in AUM, determined a vote against was warranted because “the CEO's compensation exceeds USD 19 million (or the local currency equivalent) and the company has a market cap of more than USD 100 Billion (or the local currency equivalent).” Philip Morris is number 88 on our list of overpaid CEOs. If the absolute size of the package were a factor in evaluations, the rank would have been higher.

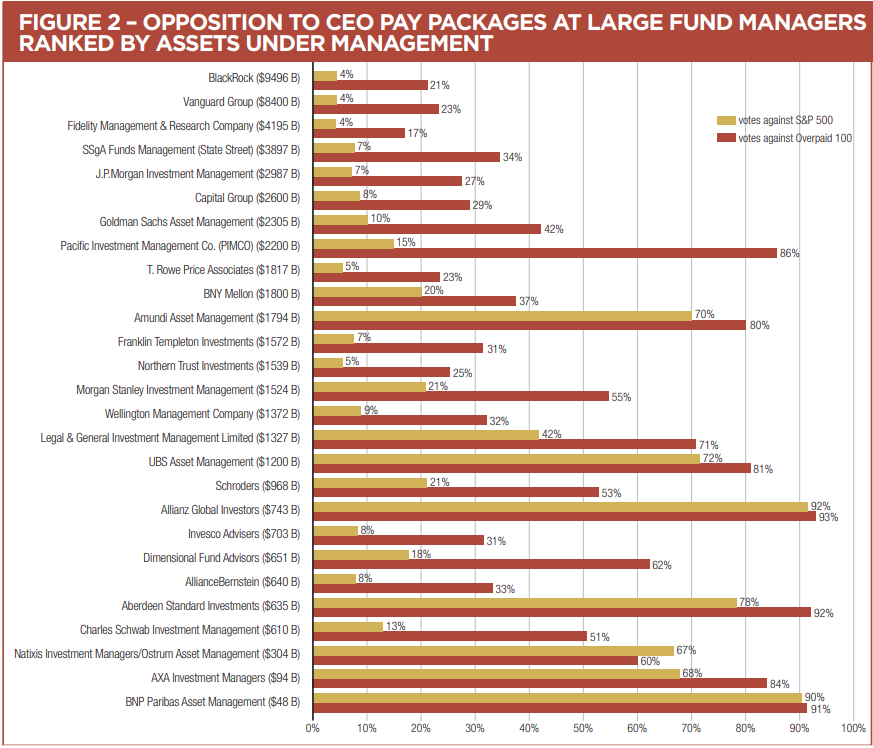

VOTING PRACTICES OF FINANCIAL FUND MANAGERS

BlackRock – $9,496 billion AUM

BlackRock voted against 4.2 percent of CEO pay packages of the S&P 500 companies and 21 percent of the 100 Most Overpaid CEOs. BlackRock has increased its against vote percentage from 2.2 percent of CEO pay packages of the S&P 500 companies and 8 percent of the 100 Most Overpaid CEOs in the previous proxy season.

BlackRock has tried to evade criticism concerning how few S&P 500 pay packages it votes against by saying that its preferred method of disagreement with pay policies is to vote against the re-election of directors. In its 2021 Investment Stewardship Report BlackRock states, “The effectiveness of voting against directors is well documented in BlackRock’s, as well as independent third-party, research. For example, our research shows that across the FTSE 350 companies where we voted against directors over remuneration concerns, 83% revised their pay policies within 12 months.”⁷

This proxy season, BlackRock reported votes against 931 directors at 453 companies due to executive compensation practices and laud this as a notable increase from the previous proxy season votes against 668 directors at 338 companies. However, As You Sow’s analysis shows that in the 2020-2021 proxy season, BlackRock voted against directors at 90 S&P 500 companies and in only eight cases listed compensation as a rationale: AmerisourceBergen, AT&T, General Electric, Howmet, Intel, Marathon Oil, Regeneron, and TransDigm Group. We thus find its contention that its vote against directors of U.S. companies as a means to express dissatisfaction with CEO pay inadequate, given that as far as we can tell 90 percent of its votes against directors are for non-compensation related reasons.

In October, BlackRock announced a new policy, effective January 1, 2022, that may be an attempt to address its critics. The New York Times referred to BlackRock’s decision to allow certain institutional clients to have more say in voting its shares. Clients can choose to vote in one of four ways:

Vote proxies themselves

Use a shareholder proxy service

Continue to allow BlackRock to vote for them

Choose certain items or topics they wish to vote themselves

In his annual letter to CEOs of the companies BlackRock holds, Larry Fink wrote, “We are committed to a future where every investor – even individual investors – can have the option to participate in the proxy voting process if they choose.”⁸

Vanguard – $8,400 billion AUM

Vanguard voted against 4.2 percent of CEO pay packages of the S&P 500 companies and 23 percent of pay packages from the 100 Most Overpaid CEOs. The vote against was the same as the previous year for S&P 500 companies, while the vote against the 100 Most Overpaid CEOs increased by 33.7 percent.

In 2021, Vanguard dramatically increased its voting disclosure with the publication of Voting Insights on key proposals. The fund published over 40 such reports, most focused on issues other than CEO pay. Of the CEO pay proposals it covered, only three are in this report, and two were used to justify votes in favor of the pay package.

Vanguard highlighted its engagement and vote against CEO pay at Chipotle Mexican Grill, number nine on our 100 Most Overpaid CEOs list, in its Investment Stewardship 2021 Semi Annual Report Insights. Vanguard stated that the upward pandemic related adjustments that excluded data for months with pandemic related store closures “too significant, given the total overall amount (or quantum) of the final payout to relative peer. Vanguard believes in a pay-for-performance philosophy centered on the concept that at-risk pay should remain at risk.”⁹

State Street Global Advisors (SSgA) – $3,897 billion AUM

SSgA voted against 7.4 percent of S&P 500 CEO pay packages and against 34.3 percent of companies on our 100 Most Overpaid CEOs list. In the previous year, it voted against 5.9 percent of S&P 500 CEO pay packages and 20 percent of the 100 Most Overpaid CEOs. SSgA abstained from voting on 1.5 percent of CEO pay packages in the most recent proxy season, a decrease on abstentions from the 3.7 percent in the previous year.

A recent State Street Report, under a section entitled “Growing Dissent in Executive Compensation,” discloses SSgA increased the percentage of votes cast against compensation proposals in North America from 5 percent in the first half of 2020 to 8 percent in the first half of 2021 and attributes the increase to high jumps in quantum, use of upward discretion, and use of special grants. ¹⁰

Amundi Asset Management – $1,794 billion AUM

Amundi Asset Management is the largest European asset manager by AUM and the eleventh largest asset manager globally. This proxy season, Amundi voted against 72.1 percent of pay packages of the S&P 500 and 78.6 percent in our 100 Most Overpaid list. This makes Amundi, which is 70 percent owned by France’s largest bank and insurer Crédit Agricole (CA), the largest European fund manager to vote against the majority of overpaid CEOs. This represents a significant increase in opposition from the prior year when Amundi only voted against 17.6 percent of pay packages in the S&P 500.

In its 2020 Engagement Report, Amundi elaborates on its remuneration policy stating, “Amundi prioritizes a fair equity pay ratio or the gap between CEO pay and the median pay level among employees (often known also as the CEO pay ratio).”¹¹

In an article entitled, “Inequality: the stark truth and how Amundi targets the root causes” Jean-Jacques Barberis, Director of the Institutional and Corporate Clients Division & ESG, says, “We have been running a dialogue with companies on the living wage over the past two years, to encourage them to develop comprehensive policies to ensure a minimum base level of benefits for all employees globally and ensure every employee is treated with the same respect”. ¹²

NEI Investments – $5.4 billion AUM

NEI Investments, founded in 2007, is a Canadian mutual fund company based in Toronto consisting of three funds – NEI Funds, Northwest Funds, and Ethical Funds – providing responsible investment solutions.

In the 2020-2021 Proxy Season, NEI Investments voted against 94.2 percent of CEO pay packages in the S&P 500. The previous proxy season, NEI voted against 90.3 percent in the S&P 500, an increase of 3.9 percentage points.

Excessive compensation is a priority issue for NEI, which states, “The potential for deep and lasting societal wounds due to the inequitable distribution of wealth is real, as we’ve seen, and the threat looms larger with every unchecked pay increase.”¹³ NEI encourages a shift for compensation committees to move from horizontal benchmarking, the practice of considering pay against the company’s competitors, to adding in vertical benchmarking, a consideration of internal pay equity.

With a focus not only on pay structure, but also deep concerns regarding quantum, NEI uses a quantified guideline to vote against pay packages it considers excessive. In the U.S., it automatically votes against when the pay package is 350 to 400 times the amount of the U.S. median household income, which correlates to CEO pay around $22 to $25 million in 2020. ¹⁴

FINANCIAL MANAGERS VOTING FOR PENSION FUNDS

Many pension systems invest in funds provided by external financial managers where the investments from multiple investors are “co-mingled” with each other. In Table 1, we highlight three such financial managers. In most cases, the pension systems delegate to the financial managers the decisions on how to vote their shares. However, in some cases, the pension systems might either have their own guidelines on how to vote their shares, or they might use a proxy voting service (following some set of guidelines provided by the service).

BlackRock is the largest financial manager and voted against only 4.2 percent of the CEO pay packages in the S&P 500 and against only 21 percent of the 100 Most Overpaid CEOs. As noted earlier, beginning in 2022, BlackRock will begin to give some institutional clients the ability to direct their own voting.

There were more pension systems that used SSgA (State Street), which has a slightly better voting record than BlackRock on CEO pay. SSgA voted against 7.4 percent in the S&P 500 CEO pay packages and against 34.3 percent of the 100 Most Overpaid CEOs.

AllianceBernstein LP voted against 7.8 percent of pay packages in the S&P 500 and against 33 percent of the 100 Most Overpaid CEOs.

| FUNDS THAT USE BLACKROCK | FUNDS THAT USE SSgA (STATE STREET) | FUNDS THAT USE ALLIANCE BERNSTEIN |

|---|---|---|

| City of Fresno Employee Retirement System | Alaska Retirement Management Board | Nevada Public Employees Retirement System |

| Employees’ Retirement System of the State of Hawaii | Arizona Public Safety Personnel Retirement System | New Mexico State Investment Council |

| Iowa Public Employees’ Retirement System (IPERS) | District of Columbia Retirement Board | Public School & Education Employee Retirement System of Missouri |

| Kansas Public Employees Retirement System | Fresno County Employees' Retirement Association | Public Employee Retirement System of Idaho |

| Nebraska Public Employees Retirement Systems | Kansas Public Employees Retirement System | |

| Nevada Public Employees Retirement System | Metropolitan Water Reclamation District Retirement Fund | |

| Public Employees Retirement System of New Mexico | Nebraska Public Employees Retirement Systems | |

| Public School and Education Employee Retirement System of Missouri | San Diego County Employees Retirement Association | |

| Texas Education Agency | Tennessee Consolidated Retirement System (TCRS) | |

| Public Employees’ Retirement System of Mississippi | Nevada Public Employees Retirement System | |

| Texas Education Agency | Oklahoma Public Employees Retirement System | |

| The Public Employees Retirement System of Mississippi | Oklahoma Teachers' Retirement System | |

| The University of Texas/Texas A&M Investment Management Company (UTIMCO) | Public Employees Retirement System of New Mexico | |

| Texas Municipal Retirement System | ||

| The Public Employees Retirement System of Mississippi | ||

| West Virginia Investment Management Board |

VOTING PRACTICES of PUBLIC PENSION FUNDS

Minnesota State Board of Investment – $129 billion AUM

The Minnesota State Board of Investment (SBI) voted against 72 percent of packages of the S&P 500 companies; it voted against 92 percent of the 100 Most Overpaid CEO pay packages. This represents a significant increase over the prior year in which they opposed 60 percent of S&P 500 packages and 88 percent of the 100 Most Overpaid CEO pay packages.

SBI’s ESG Stewardship Report, published in January 2021, reports that in 2021, the SBI voted against approximately 70 percent of CEO pay packages “due to lack of sufficient alignment or transparency with shareholders.”¹⁵ The fund evaluates proposals on a case-by-case basis, with an emphasis on the fact that compensation should be linked to long-term performance. The figure disclosed in the report is based on all votes cast, not simply S&P 500 or even Russell 3000.

New York City Employees’ Retirement System – $207 billion AUM

The New York City Pension Funds voted against 31.7 percent of pay packages of the S&P 500 companies; they voted against 78.13 percent of the 100 Most Overpaid CEO pay packages. This marks a significant improvement over the prior year in which they opposed 25 percent of S&P 500 packages and 65 percent of the 100 Most Overpaid CEO pay packages.

CONCLUSION

The pandemic has led to a greater awareness of the pay inequity between CEOs and the average worker and a realization that those with pay most “at risk” were average workers. While compensation committees like to tout the amount of the pay package that is “at risk,” the pandemic challenged the notion that CEO pay will always rise and fall with the performance of the company. In this report we have highlighted some of the compensation committee decisions to protect their CEOs from the financial impacts that their own employees have had to weather under COVID-19.

While we have seen a growing rejection of CEO pay packages from many of the largest mutual funds and pension funds, change has been unconscionably slow. In the past year, there has been a dramatic increase in the number of pay packages that have been rejected and a dramatic increase in the number of negative votes at the average S&P 500 company. However, with the big three financial managers – BlackRock, Vanguard, and SSgA – who together control about 20 percent of all shareholder votes and are still approving about 95 percent of S&P 500 CEO pay packages, the number of rejections is far from what it should be. This pay growth is both unjustified and decidedly not in the best interest of shareholders.

APPENDIX A – THE 100 MOST OVERPAID CEOs

Click on each column name to sort.

APPENDIX B – S&P 500 COMPANIES WITH MOST SHAREHOLDER VOTES AGAINST CEO PAY

This appendix shows two ways of looking at CEO pay votes: the standard one, as disclosed by the company, and one that was created for us by Insightia, a Diligent Brand. It uses only the votes of institutional investors (those required to file SEC Form 13F). In these calculations, those votes are used in both the numerator (shares voted against) and denominator (total shares voted) to calculate percentage opposition. We believe this gives a more accurate indication of where institutional investors are most dissatisfied, most starkly in cases where insiders own a particularly large portion of stock or there are dual class shares.

| Rank | Company | CEO | Voted Against (institutional) |

Voted Against (standard) |

Pay |

|---|---|---|---|---|---|

| 1 | Universal Health Services | Alan B. Miller | 100% | 10% | $13,246,214 |

| 2 | Norwegian Cruise Line | Frank Del Rio | 96% | 83% | $36,381,255 |

| 3 | ViacomCBS | Robert M. Bakish | 95% | 5% | $38,973,768 |

| 4 | Paycom Software | Chad Richison | 93% | 70% | $211,131,206 |

| 5 | Under Armour | Patrik Frisk | 88% | 19% | $7,365,232 |

| 6 | Discovery | David M. Zaslav | 86% | 39% | $37,710,462 |

| 7 | Las Vegas Sands | Sheldon Gary Adelson | 84% | 30% | $11,344,715 |

| 8 | Skyworks Solutions | Liam K. Griffin | 82% | 78% | $21,800,439 |

| 9 | DXC Technology | Michael J. Salvino | 79% | 67% | $21,733,120 |

| 10 | T-Mobile US | G. Michael Sievert | 78% | 18% | $54,914,015 |

| 11 | Howmet Aerospace | John C. Plant | 77% | 55% | $39,091,008 |

| 12 | Oracle | Safra A. Catz | 74% | 41% | $964,055 |

| 13 | AmerisourceBergen | Steven H. Collis | 72% | 48% | $14,295,140 |

| 14 | Marathon Petroleum | Michael J. Hennigan | 72% | 70% | $15,534,265 |

| 15 | Walgreens Boots Alliance | Stefano Pessina | 72% | 52% | $17,483,187 |

| 16 | Electronic Arts | Andrew Wilson | 70% | 74% | $39,165,820 |

| 17 | Intel | Robert H. Swan | 69% | 62% | $22,389,500 |

| 18 | Alphabet | Sundar Pichai | 69% | 25% | $7,425,547 |

| 19 | IQVIA | Ari Bousbib | 68% | 54% | $25,575,986 |

| 20 | PTC | James Heppelmann | 63% | 50% | $47,303,293 |

| 21 | General Electric | H. Lawrence Culp Jr. | 62% | 58% | $73,192,032 |

| 22 | AT&T | John Stankey | 59% | 51% | $21,020,917 |

| 23 | NIKE | John J. Donahoe II | 55% | 46% | $53,499,980 |

| 24 | Sealed Air | Edward L. Doheny II | 54% | 45% | $11,764,199 |

| 25 | Phillips 66 | Greg Garland | 54% | 50% | $24,989,374 |

| 26 | Chipotle Mexican Grill | Brian R. Niccol | 53% | 49% | $38,035,868 |

| 27 | Wynn Resorts | Matthew Maddox | 52% | 36% | $24,571,980 |

| 28 | International Business Machines | Arvind Krishna | 52% | 51% | $17,009,682 |

| 29 | Halliburton | Jeffrey A. Miller | 50% | 54% | $22,319,385 |

| 30 | Biogen | Michel Vounatsos | 48% | 49% | $18,659,829 |

| 31 | TransDigm | Kevin Stein | 48% | 57% | $22,060,463 |

| 32 | Copart | A. Jayson Adair | 46% | 44% | $25,766,923 |

| 33 | Hilton | Christopher J. Nassetta | 45% | 43% | $55,870,639 |

| 34 | Regeneron Pharmaceuticals | Leonard S. Schleifer | 44% | 30% | $135,350,121 |

| 35 | Fiserv | Frank J. Bisignano | 43% | 37% | $12,193,925 |

| 36 | Starbucks | Kevin R. Johnson | 42% | 53% | $14,665,575 |

| 37 | Netflix | Reed Hastings | 41% | 49% | $43,226,024 |

| 38 | Wells Fargo | Charles W. Scharf | 40% | 42% | $20,392,046 |

| 39 | Kansas City Southern | Patrick J. Ottensmeyer | 40% | 48% | $7,135,912 |

| 40 | Aptiv PLC | Kevin P. Clark | 38% | 43% | $31,267,329 |

| 41 | Cardinal Health | Michael C. Kaufmann | 38% | 39% | $14,217,127 |

| 42 | Kraft Heinz | Miguel Patricio | 38% | 16% | $6,140,131 |

| 43 | Centene | Michael F. Neidorff | 37% | 37% | $24,956,777 |

| 44 | Lennar | Richard Beckwitt | 36% | 16% | $21,983,118 |

| 45 | Johnson & Johnson | Alex Gorsky | 35% | 43% | $29,575,974 |

| 46 | Prologis | Hamid R. Moghadam | 35% | 48% | $34,432,677 |

| 47 | Activision Blizzard | Robert A. Kotick | 33% | 44% | $154,613,318 |

| 48 | NXP Semiconductors | Kurt Sievers | 31% | 35% | $19,253,302 |

| 49 | Hologic | Stephen MacMillan | 30% | 31% | $14,125,674 |

| 50 | DaVita | Javier Rodriguez | 30% | 17% | $73,432,365 |

| 51 | Lincoln National | Dennis R. Glass | 30% | 28% | $14,300,822 |

| 52 | Berkshire Hathaway | Warren Buffett | 27% | 7% | $380,328 |

| 53 | Ford Motor | James D. Farley Jr. | 26% | 11% | $11,802,054 |

| 54 | Vornado Realty Trust | Steven Roth | 26% | 23% | $11,047,233 |

| 55 | Becton, Dickinson and Company | Thomas Polen | 25% | 33% | $11,669,426 |

| 56 | eBay | Jamie Iannone | 25% | 29% | $34,835,839 |

| 57 | Regions Financial | John M. Turner Jr. | 24% | 29% | $13,832,516 |

| 58 | Royal Caribbean | Richard D. Fain | 23% | 22% | $12,083,503 |

| 59 | Walt Disney | Robert A. Chapek | 23% | 32% | $14,163,936 |

| 60 | Estee Lauder | Fabrizio Freda | 22% | 2% | $18,423,927 |

| 61 | UnitedHealth Group | David S. Wichmann | 22% | 27% | $17,872,713 |

| 62 | Hasbro | Brian D. Goldner | 21% | 19% | $16,668,010 |

| 63 | Fox | Lachlan Murdoch | 20% | 9% | $29,154,460 |

| 64 | Nucor | Leon J. Topalian | 19% | 25% | $11,265,538 |

| 65 | D.R. Horton | David V. Auld | 19% | 20% | $19,197,322 |

| 66 | Mastercard | Ajay S. Banga | 18% | 25% | $27,774,448 |

| 67 | Textron | Scott Donnelly | 17% | 27% | $17,770,781 |

| 68 | Illumina | Francis A. deSouza | 16% | 18% | $11,733,593 |

| 69 | American International Group | Brian Duperreault | 16% | 26% | $18,810,374 |

| 70 | Ross Stores | Barbara Rentler | 15% | 16% | $17,518,158 |

| 71 | C.H. Robinson Worldwide | Robert C. Biesterfeld | 14% | 16% | $5,432,670 |

| 72 | CenterPoint Energy | David J. Lesar | 14% | 20% | $11,946,295 |

| 73 | Amazon | Jeffrey P. Bezos | 14% | 19% | $1,681,840 |

| 74 | Arista Networks | Jayshree Ullal | 14% | 10% | $6,342,972 |

| 75 | United Airlines | J. Scott Kirby | 14% | 18% | $8,891,854 |

| 76 | American Airlines | W. Douglas Parker | 14% | 13% | $10,663,866 |

| 77 | Allegion Plc | David D. Petratis | 13% | 15% | $8,785,585 |

| 78 | Archer-Daniels-Midland Company | Juan Luciano | 13% | 14% | $21,994,433 |

| 79 | Gap | Sonia Syngal | 13% | 12% | $21,905,521 |

| 80 | Invesco | Martin Flanagan | 13% | 12% | $11,747,102 |

| 81 | Micron Technology | Sanjay Mehrotra | 13% | 15% | $19,995,488 |

| 82 | Republic Services | Donald W. Slager | 13% | 8% | $12,937,163 |

| 83 | Automatic Data Processing | Carlos A. Rodriguez | 12% | 10% | $17,645,648 |

| 84 | Fifth Third Bancorp | Greg D. Carmichael | 12% | 13% | $9,766,478 |

| 85 | Comcast | Brian Roberts | 12% | 12% | $32,713,267 |

| 86 | Thermo Fisher Scientific | Marc N. Casper | 12% | 17% | $26,390,073 |

| 87 | Omnicom | John D. Wren | 12% | 12% | $11,147,799 |

| 88 | Valero Energy | Joseph W. Gorder | 12% | 10% | $19,922,417 |

| 89 | Live Nation Entertainment | Michael Rapino | 12% | 6% | $4,781,510 |

| 90 | People's United Financial | John Barnes | 12% | 15% | $5,800,085 |

| 91 | MGM Resorts International | William Joseph Hornbuckle | 12% | 12% | $13,988,135 |

| 92 | Xylem | Patrick K. Decker | 12% | 14% | $8,830,351 |

| 93 | Ralph Lauren | Patrice Louvet | 11% | 3% | $12,063,568 |

| 94 | Texas Instruments | Richard K. Templeton | 11% | 12% | $19,056,652 |

| 95 | Tractor Supply | Harry A. Lawton III | 11% | 14% | $15,812,073 |

| 96 | Ventas | Debra A. Cafaro | 11% | 14% | $12,628,714 |

| 97 | Equinix | Charles Meyers | 11% | 21% | $25,836,268 |

| 98 | Fortive | James A. Lico | 11% | 13% | $13,624,063 |

| 99 | Akamai Technologies | F. Thomson Leighton | 11% | 12% | $11,750,560 |

| 100 | Bio-Rad Laboratories | Norman Schwartz | 11% | 3% | $7,992,423 |

APPENDIX C – HIP INVESTOR REGRESSION ANALYSIS

This table lists Overpaid CEOs as calculated by the HIP Investor regression analysis, comparing CEO pay to company financial performance returns to shareholders.

We, like many other analysts, find very weak links between pay amounts and company financial performance. The usual justification for high executive pay is that higher pay is intended to be a reward for higher profits and above average capital appreciation. Yet, this does not always follow – and shareholders foot the bill of excess pay. And, shareholders in firms that overpay their CEOs also suffer lagging financial performance.

However, if we follow the assumption that pay should be determined by performance and then use a basic statistical technique to map actual performance outcomes to predicted levels of pay relative to those outcomes, we can then see how much the CEO pay package exceeded such a prediction. Those with highest excess are ranked in the table below – and constitute this list of Overpaid CEOs of the S&P 500.

Executive pay data series included:

Raw data: Simply looking at every ISS-identified executive’s pay package, in each year, as a single data point value – including pay, bonus, stock grants, and stock options – to be paired with financial performance for that year.

The series is supplemented using a Refinitiv, an LSEG (London Stock Exchange Group) business, (formerly Thomson Reuters Asset4) data set that captures the single largest pay package for each (company, year) pair. If ISS did not report a CEO for a given pair, and that pair was available in the Refinitiv series, the Refinitiv data were included. Once the full set of pay packages is assembled, each (company, year) value is paired with the performance for that year, and this full set is used for the regression.

Each type of executive pay could be reported in any year analyzed from 2009 to 2021, though not every company was reported for every year.

Financial performance series factors included:

Return on invested capital (ROIC = cash flow available to pay both debt and equity capital owners, adjusted for tax effects, divided by the total value of that capital). ROIC is sourced from Refinitiv, which sources data from companies’ annual reports and investor filings.

Total return (capital gains and dividends) on the company’s primary equity. This is calculated from the Refinitiv Return Index series using trailing periods behind June 30 of the year of the pay package as identified by ISS (or matching the year for the supplementary largest package data from ASSET4). Both performance factors were calculated across one-year, three-year, and five-year windows, trailing behind each possible pay year. Thus, data were considered as far back as 2004 (for the five-year window trailing pay data from 2009).

APPENDIX D – FINANCIAL FUND MANAGERS’ OPPOSITION TO CEO PAY

This table summarizes more than 100 financial fund managers on their CEO pay votes at all S&P 500 companies and the 100 companies with the Most Overpaid CEOs.

APPENDIX E – PENSION FUND OPPOSITION TO CEO PAY

Data provided by Insightia, a Diligent Brand.

APPENDIX F – OVERPAID CEOS UNDERPERFORM YEAR AFTER YEAR

By HIP Investor (Onindo Khan and R.Paul Herman)

Since 2015, As You Sow and HIP Investor have identified the 100 Most Overpaid CEOs – and how the overpaid group lags the overall index peer group.

Over the years, while CEOs have turned over and companies have adapted their executive pay approach, each year’s list has had recurring overpaid CEOs, as well as newly overpaid CEOs.

Only seven companies have been named on each and every list over the past eight years, and a total of 270 different companies have been on the annual Most Overpaid CEOs list. However, the insights have remained consistent:

Despite assertions by pay experts that CEOs are rewarded for great performance, CEO compensation is typically not correlated to past stock return performance. ¹⁶

Despite ongoing stock market records, a pandemic, and associated federal stimulus, annualized worker pay increases of 2 percent dramatically lag annualized CEO pay increases of 16 percent or more, year over year. ¹⁷

Despite the claim of competition for highly coveted leadership roles, the most highly paid CEOs earn obscene, unreasonable amounts, sometimes over $100 million in a single year – 2,000 times the average worker in the U.S.

HIP Investor’s analysis shows that the companies with the 100 Most Overpaid CEOs have underperformed the equal-weighted average S&P 500 company for each and every report. Whether in 2015, 2016, 2017, 2018, 2019, 2020 or 2021, the lag in performance ranged from -1 percentage point to more than -3 percentage points.

FIGURE 1: THE MOST OVERPAID CEOS OF EACH REPORT SINCE 2015 HAVE LAGGED THE EQUAL WEIGHTED S&P 500

Annualized TSR since publishing of each Overpaid CEO report from the past six years: 2015 to year-end 2021

To avoid any single year and especially the COVID-19 year affecting our analysis unduly, we also considered the performance of the Most Overpaid 100 each year after they were named. From 2015 to 2019, the most overpaid CEOs firms lagged the year after being called out. Up to the date of the analysis, the 2021 most overpaid companies are on track to match the worst underperformance we have seen. Thus, the subsequent performance of the firms did not reflect the asserted excellence that would justify an exorbitant pay package.

A trivial investment strategy that can be designed based on the As You Sow report is to track the equal weighted S&P 500 but to divest, underweight, or even short-sell the companies published in the latest report. This strategy of investing in firms without overpaid CEOs could have gained +5 percentage points cumulative over the equal weighted S&P500 from 2015 to end of year 2021.

The inverse strategy of only tracking the worst 100 and updating them each year would have underperformed by more than -20 percentage points cumulatively across almost seven years.

If savvy investors sold, shorted, or underweighted the 100 Most Overpaid firms reported annually by As You Sow, those portfolios could have earned more than the stock market average.

This Most Overpaid CEO report can be a useful tool for investors, advisers, and fund managers and for 401(k) fiduciaries.

Overpaid CEOs are a warning- sign of investment risk – and can negatively impact your portfolio.

Your portfolio is your money. The companies and funds you invest in should be aligned with your values and way of seeing the world.

FIGURE 2: MOST OVERPAID 100 UNDERPERFORMS YEAR AFTER YEAR

Annualized TSR lag to equal weighted S&P 500 since publishing of each CEO Pay Report from 2015 to year-end 2021

FIGURE 3: 100 MOST OVERPAID UNDERPERFORM MOST YEARS AFTER THEY ARE NAMED

Absolute TSR lag to equal weighted S&P 500 one year after publishing of each CEO Pay Report from 2015 to year-end 2021

However, the Most Overpaid CEO pay packages are approved by boards elected by you, the investor, and the mutual funds who hold their stocks.

We encourage you as investors to speak up, vote against Overpaid CEOs, and pressure the companies and funds in your portfolio with this evidence – which can benefit your long-term financial performance and a more appropriate level of rewards for results achieved.

FIGURE 4: PORTFOLIO EXCLUDING THE 100 MOST OVERPAID OUTPERFORMS

Value of portfolio comparing equal weighted S&P 500, Most Overpaid 100, and equal weighted S&P 500 excluding the 100 Most Overpaid from publishing of first report to end of year 2021

ENDNOTES

Semler Brossy, 2021 Say on Pay & Proxy Results, January 27, 2022, https://semlerbrossy.com/wp-content/uploads/2022/01/SBCG-2021-SOP-Report-2022-01-31.pdf

Rachel Hendrick, David Kokell, Kevan Marvasi, Chris Scoular, Galen Spielman, Mete Tepe, Juliana Vaughn, and Liz Williams, “2021 Proxy Review – United States Compensation,” Institutional Shareholder Services, August 18, 2021, https://insights.issgovernance.com/posts/2021-united-states-compensation-2021-proxy-season-review/.

Lawrence Mishel and Jori Kandra, “CEO Pay Has Skyrocketed 1,322% since 1978: CEOs Were Paid 351 Times as Much as a Typical Worker in 2020,” Economic Policy Institute, August 10, 2021, https://www.epi.org/publication/ceo-pay-in-2020/.

Harriet Agnew, “LGIM Ends Feedback on Executive Pay after Finding It Mostly Ignored,” Financial Times, November 21, 2021, ft.com/content/785665a6-3d28-4516-9aad-60bb404b2ba3

Greg Ryan, “Shareholder Groups Urge ‘No’ Vote on GE Exec Pay,” Boston Business Journals (April 16, 2021), https://www.bizjournals.com/boston/news/2021/04/16/shareholder-groups-urge-no-vote-on-ge-exec-pay.html.

PX14A6G filed by CtW Investment Group, April 6, 2021, https://www.sec.gov/Archives/edgar/data/40545/000137773921000011/ge21voteno.htm.

BlackRock. (2021). Pursuing Long-Term Value for Our Clients: BlackRock Investment Stewardship, https://www.blackrock.com/corporate/literature/publication/2021-voting-spotlight-full-report.pdf.

Larry Fink, “The Power of Capitalism,” Larry Fink’s 2022 Letter to CEOs.

Vanguard, Investment Stewardship 2021 Semiannual Report (2021), 24, https://global.vanguard.com/documents/investment-stewardship-semiannual-report.pdf.

State Street, Asset Stewardship Report, 8, https://www.ssga.com/library-content/products/esg/asset-stewardship-activity-q2-2021.pdf.

Amundi Asset Management, Amundi 2020 Engagement Report, 2020, https://about.amundi.com/Sites/Amundi-Corporate/Pages/News/2021/Amundi-2020-Engagement-Report.

Amundi Asset Management, “Inequality: The Stark Truth and How Amundi Targets the Root Causes,” October 21, 2020, https://www.esg-amundi.com/100percentesg/p/9.

NEI Investments, “A Promising Start to the Challenge of Excessive CEO Pay,” May 20, 2021, http://blog.neiinvestments.com/a-promising-start-to-the-challenge-of-excessive-ceo-pay/.

Hasina Razafimahefa and Lucia Lopez, “The ‘COVID Cut’ Is Not Enough: Addressing the Negative Social Impacts of Excessive Executive Compensation,” November 5, 2020, https://www.riacanada.ca/magazine/the-negative-social-impacts-of-excessive-executive-compensation/.

SBI Minnesota State Board of Investment, ESG Stewardship Report: Fiscal Year 2021, 9, https://msbi.us/sites/default/files/2022-01/MSBI%20ESG%20Stewardship%20Report%20FY2021.pdf.

Our HIP Investor team each year analyzed multiple financial indicators over different timeframes for all S&P500 companies and consistently found extremely low correlations (single digit correlation coefficients) between CEO pay and historical financial performance. This aligns with the academic research over the past 20 years (recently Martin Larraza-Kintana (Ed.), Management Research 16, no. 1 (2018): https://www.emerald.com/insight/publication/issn/1536-5433/vol/16/iss/1 and seminally Henry L. Tosi, Steve Werner, Jeffrey P. Katz, and Luis Gomez-Mejia, “How Much Does Performance Matter? A Meta-Analysis of CEO Pay Studies,” Journal of Management 26, no. 2 (2000): 301-339, https://asu.pure.elsevier.com/en/publications/how-much-does-performance-matter-a-meta-analysis-of-ceo-pay-studi).

Lawrence Mishel and Jori Kandra, “Preliminary Data Show CEO Pay Jumped Nearly 16% in 2020, While Average Worker Compensation Rose 1.8%, Working Economics (blog), Economic Policy Institute, May 27, 2021, https://www.epi.org/blog/preliminary-data-show-ceo-pay-jumped-nearly-16-in-2020-while-average-worker-compensation-rose-1-8/.

LEGAL DISCLAIMER

The information provided in this report is provided “AS IS” without warranty of any kind. As You Sow makes no representations and provides no warranties regarding any information or opinions provided herein, including, but not limited to, the advisability of investing in any particular company or investment fund or other vehicle. While we have obtained information believed to be objectively reliable, neither As You Sow nor any of its employees, officers, directors, trustees, or agents, shall be responsible or liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any information contained herein, including, but not limited to, lost profits or punitive or consequential damages. Past performance is not indicative of future returns.

As You Sow does not provide investment, financial planning, legal, or tax advice. We are neither licensed nor qualified to provide any such advice. The content of our programming, publications, and presentations is provided free of charge to the public for informational and educational purposes only, and is neither appropriate nor intended to be used for the purposes of making any decisions on investing, purchases, sales, trades, or any other investment transactions.

Our events, websites, and promotional materials may contain external links to other resources, and may contain comments or statements by individuals who do not represent As You Sow. As You Sow has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third party websites or services that you may access as a result of our programming. As You Sow shall not be responsible or liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any such content, goods, or services available on or through any such websites or services.

Authors

Rosanna Landis Weaver is the Wage Justice and Executive Compensation Senior Program Manager at As You Sow®.

This is the eighth annual report of “The 100 Most Overpaid CEOs of the S&P 500: Are Fund Managers Asleep at the Wheel?” that Weaver has written for As You Sow. Weaver began her corporate governance career with a position in the corporate affairs office at the International Brotherhood of Teamsters in 1992 supervising research on corporate governance. She then worked for the Investor Responsibility Research Center (IRRC), and in 2005 she joined Institutional Shareholder Services (ISS) where she was a senior analyst on the executive compensation team. Weaver holds a bachelor’s degree in English from Goshen College and a master’s in American Studies from the University of Notre Dame.

Melissa Walton is a research associate at As You Sow supporting the Executive Compensation and Say on Climate programs. Melissa spent her early career in environmental and natural science education and more recently has completed quantitative and qualitative research and reports for nonprofit organizations on a variety of sustainability topics. She holds a bachelor’s degree from Emory University, a master’s in environmental management from Duke University, and an MBA from Presidio Graduate School.

Throughout the spring, this team provides updates and compensation analysis on its blog, which can be found at https://www.asyousow.org/our-work/ceo-pay/blog/. You can sign up for emails that summarize these blog posts at https://www.asyousow.org/our-work/ceo-pay.

Acknowledgements

This report was made possible by the generous support of the Stephen M. Silberstein Foundation. Additional support was provided by the Argosy Foundation, Arkay Foundation, Arntz Family Foundation, Firedoll Foundation, Fred Gellert Family Foundation, Hanley Foundation, Laird Norton Family Foundation, Manaaki Foundation, Roddenberry Family Foundation, and Singing Field Foundation.

Special thanks to:

The database of Insightia, a Diligent Brand, provided valuable information. Oliver Taylor was extremely helpful with reams of data and remained patient while answering numerous specific questions.

The Human Impact + Profit (HIP) Investor team conducted the regression analysis of CEO Pay to total shareholder returns, upon which a key component of this report rests. HIP Investor (www.HIPInvestor.com), founded in 2006, rates 140,000 investments (stocks, bonds, funds) on all aspects of sustainability (including corporate CEO pay) and how it can correlate to future risk and return potential. Onindo Khan, R. Paul Herman (HIP’s CEO and annual webinar panelist), and Cole Gleeson once again contributed original research for us.

Robert Reich and Inequality Media for their support for this project and their efforts to educate and engage the public on inequality and work toward a more just economy. We greatly appreciate Robert Reich’s contribution to our webinar and bringing a systems perspective to widening inequality and its impacts. Sincere thanks to him and his staff at Inequality Media, including Heather Kinlaw Lofthouse and Michael Lahanas-Calderón.

The As You Sow team (alphabetically by last name): Andrew Behar, Jill Courtenay, Ryon Harms, Wesley Henjum, Susan Honea, Hillary Keller, Sarah Milne, Stefanie Spear, Robin Turner, and Jesse Velasquez. Special thanks to John Opet of Art270.